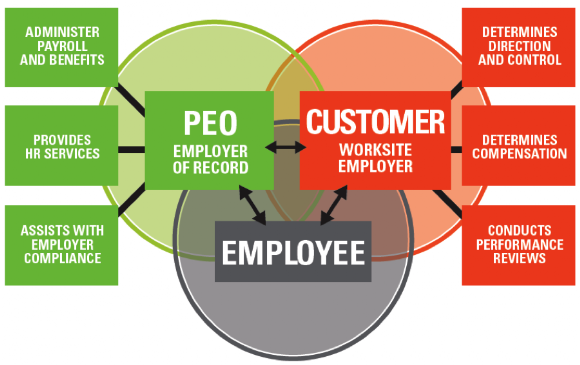

The Co-Employment Relationship

In Co-Employment the PEO becomes the employer of record for tax purposes, filing paperwork under its own identification numbers. The client company continues to direct the employees' day-to-day activities. PEOs charge a service fee for taking over the human resources and payroll functions of the client company. This fee is in addition to the normal employee overhead costs, such as the employer's share of FICA, Medicare, and unemployment insurance withholding.

One key service usually provided by a PEO is to secure Workers Compensation insurance coverage at a lower cost than client companies can obtain on an individual basis. Essentially, a PEO obtains Workers Compensation coverage for its clients by negotiating insurance coverage that covers not just the PEO but also the client companies. This is allowed because legally the PEO is the Co-Employer of the workers at the client companies.

Use of a PEO saves time and staff that would be used to prepare payroll and administer benefits plans, and may reduce legal liabilities or obligations to employees that it would otherwise have. The client company may also be able to offer a better overall package of benefits, and thus attract more skilled employees.